As we all know the covid-19 have affected in our daily life and business for 3 years. Many businessman are looking for the new way to live in the market and struggling in the weak market economy. Under the governments taking many measuring to protect the people and economy, People get the confidence on the life and daily consumer in recent years.So what impact has the Covid-19 made in the international hardware trade ?

My country has always attached great importance to promoting the development of advanced technology and production technology, constantly breaking the technical barriers to the manufacture of high-strength and ultra-high-strength fasteners in developed countries, and gradually striding forward to a fastener manufacturing powerhouse. My country has now become the first fastener manufacturer.

As a major producing country, the fastener industry has maintained steady growth overall in recent years. According to the data, the output of metal fasteners in China increased from 6.28 million tons in 2016 to 7.43 million tons in 2019, with an average annual compound growth rate of 5.9%. In 2020, affected by the new crown epidemic, the output of metal fasteners decreased by 1.12 million tons year-on-year, a decrease of 15.07% year-on-year. China Business Industry Research Institute predicts that China's metal fastener production will reach 7.16 million tons in 2022.

In terms of industry revenue, China's fastener industry revenue is in a slow decline after reaching a peak of 152.3 billion yuan in 2017, and will reach 121.2 billion yuan in 2020. The China Business Industry Research Institute predicts that the revenue of China's fastener industry will reach 121.7 billion yuan in 2022.

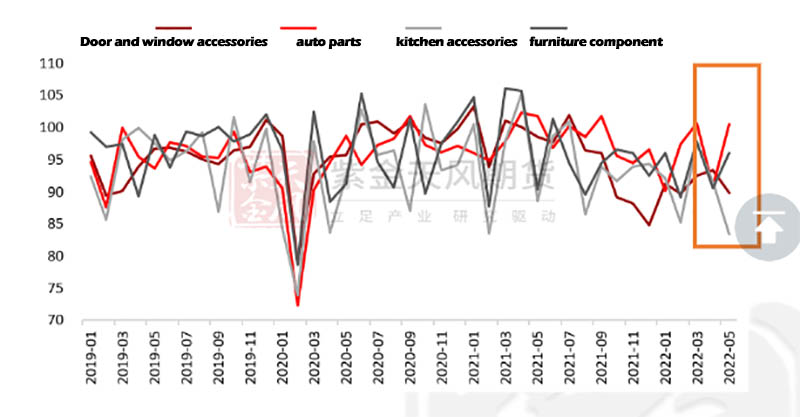

For half a year, the prosperity of doors and windows, kitchen appliances, furniture hardware, etc. continued to be sluggish, the terminal orders of alloy enterprises were obviously weak, and the overall operating rate was also relatively low in the past ten years.

1.Compared with domestic demand, H1 alloy export orders are relatively good, but the absolute consumption is still small.

2.With the gradual recovery of the automobile industry chain, the prosperity of auto parts hardware has risen in May, and it is expected that it will become the main growth point of alloy demand in the second half of the year.

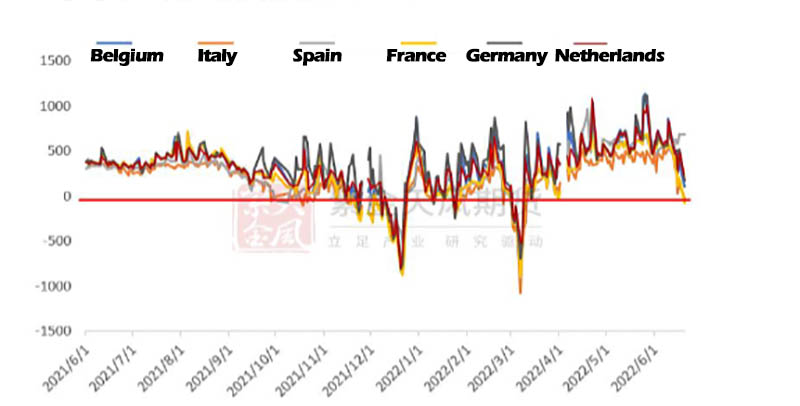

The focus this year in terms of overseas refined zinc supply has been on European smelters. Affected by the conflict between Russia and Ukraine in the first half of the year, the price of natural gas in Europe soared for a while, and the cost of some smelters rose and was forced to cut down.

Produce. Nyrstar's Auby smelter has only been operating at about 50% capacity since Q2, and Glencore's Portovesme smelter has not resumed production. Therefore, we expect H1 overseas refinery .Zinc smelting output fell around 3% year-on-year.

1.As of 6.20, TTF Dutch natural gas prices rose to a high of around 120 euros/MWh, and the average profit of some European smelters fell significantly. It now appears that European energy risks will be greater in the second half of the year

The probability will continue, some local smelters still have the possibility of reducing production, and some North American zinc smelters are facing operational and quality problems, and there have been basically no new projects at the overseas smelting end in the past two years;

2.Under optimistic expectations, we assume that Auby will continue to operate at half of its production capacity and Portovesme will operate at 30% of its production capacity since Q3. It is estimated that the overseas refined zinc supply will be around 7.32 million tons in 2022.